Please note that the opinions in this article are our own. We are not advertising, or being paid to write about these services.

We do quite a bit of e Commerce web design here at True North Social. We’ve been getting a lot of questions from our clients lately about Buy Now Pay Later apps (BNPL for short) and whether or not they should use them.

For many retailers who participate in e-Commerce and run an online store, partnering with buy now, pay later apps (BNPL) is a good move to increase online sales. BNPL apps are similar to credit cards in that you pay for your purchase over time, however, unlike credit cards, many BNPL apps offer interest-free payments for these purchases as long as the buyer makes the scheduled payments on time.

BNPL apps are attractive for many electronic commerce businesses and their customers because they offer low fees and interest rates, while also providing enough of a credit limit to accommodate common online purchases. We’ll go over how these apps work in greater detail, and help you pick the best one for your electronic commerce business.

Our Favorite Buy Now, Pay Later Apps of 2024

Affirm

Affirm is our favorite buy now, pay later app overall.

We chose this as our favorite because it has 0 fees. Seriously. There are no fees of any kind, not even a late fee.

When it comes to interest, if there is a purchase where you pay interest, Affirm charges simple interest, meaning your interest charges won’t grow larger.

Pros & Cons

Pros

- You can make purchases online or in-store

- Purchases up to $17,500 can be made

- Consumers choose their payment schedule

- No late fees

Cons

- Requires credit check

- No physical credit card

- Some purchases charge interest

Affirm was founded in 2012 and is located in San Francisco, CA. To date Affirm has financed over 17 million purchases from many e commerce sites. There is a borrowing limit of $17,500 which customers can pay over time. Interest rates vary from 0% – 30%, depending on the e commerce retailer. Most loans from affirm are paid within 3-12 months, resulting in zero fees.

Affirm makes it easy and straightforward for borrowers. They know exactly what they are paying and when payments will be done. Several online retailers offer Affirm as a payment option when checking out. If a retailer doesn’t offer Affirm, customers can still use it by creating a virtual credit card number through the Affirm mobile app.

Sezzle

Our second favorite buy now, pay later app is Sezzle. We chose this app because of it’s flexible payment plans. Sezzle allows customers to reschedule payments up to two weeks past their payment due date. They also don’t charge interest!

Pros & Cons

Pros

- No interest on purchases

- First reschedule per order is free

- Can reschedule subsequent payments for free at the same time

- Payments can be pushed back by two weeks

Cons

- 25% down payment is required at time of purchase

- Additional payments aren’t rescheduled if you don’t select the option

- If you need to reschedule your payments again after your first free reschedule, there is a $5 fee.

Sezzle is available to online stores and customers in both the U.S. and Canada, and operates out of Minneapolis, MN. Sezzle is a Certified B Corp, meaning that profits are used to support a public benefit. Over 2.6 million customers have partnered with Sezzle for their purchases, and the top 10% of those customers use Sezzle around 49 times per year. Sezzle currently partners with about 34,000 merchants.

Many buy now, pay later apps require a 25% down payment, just like Sezzle, the difference being that Sezzle will allow customers to reschedule payments up to two weeks after their due date, making it a great choice for consumers who need flexibility. The first reschedule per order is free, and any additional changes after that come with a $5 fee. You can reschedule all of your remaining payments on your order at once to avoid additional schedule change fees.

Afterpay

Next on our list of favorite buy now, pay later apps is Afterpay. This app is great for students in particular. Afterpay utilizes smart credit limits to ensure that customers can pay for the online shopping purchases funded. Afterpay also allows any purchase of over $100 to be split into four payments. Making it much easier for those on a tight budget.

Pros & Cons

Pros

- No fees when payments are made on time

- Payment reminders to help consumers remember to pay

- Smart credit limit to ensure purchases are within the customer’s budget.

Cons

- Purchases must be approved by Afterpay

- Afterpay may decline your order

- Late fees can be steep, as much as 25% of your order amount.

Afterpay is based in Australia and available to consumers in Australia, New Zealand, the U.K, Canada, and the U.S. Since it’s launch in 2015 Afterpay has funded over 14.6 million customers globally. Afterpay partners with over 85,000 brands, meaning customers have a lot of great options for shopping.

Purchases can be made at participating stores either online or at brick and mortar stores with no fees or interest as long as scheduled payments are made on time.

For every purchase you make, you are subject to an instant approval decision using smart credit limits. This not only protects Afterpay, but the consumer as well, making it a great option for students who may be new to managing their own budgets.

Use the Afterpay mobile app to shop in-store, then add the virtual card number to your mobile wallet and tap to pay. The first payment (25%) will be made at the time of your transaction, then the remaining three payments will be due every 2 weeks. If your payment is late, you will be charged up to 25% of the original purchase price, with a maximum fee of $8.

Splitit

If you are looking for a buy now, pay later app that doesn’t use a credit check, Splitit is a great option. Instead of issuing a separate credit, Splitit uses your existing Visa or Mastercard credit cards to fund online shopping purchases.

Pros & Cons

Pros

- No credit checks, applications, or registration is required

- Splitit has the highest transaction approval rating

- Uses the limits of your existing credit cards

Cons

- Doesn’t help to build credit

- Not available with Amex or Discover cards

- Consumers must have available credit on their existing credit cards

Splitit was founded in 2012, and is based in New York City. Splitit is partnered with Visa, Mastercard, Google, Stripe, and more in order to expand its offerings to a large consumer base.

When customers use Splitit, they continue to use their Visa or Mastercard as normal, while earning any rewards those cards may feature, while being able to pay over time with no interest. Splitit doesn’t charge it’s users any fees or interest, including late fees.

When opting to use Splitit at checkout, customers will choose how many payments they want to make for their purchase, then enter their credit card information. There is no credit check, application, or registration required. There are also no interest charges or fees as long as payments are made on time.

When you make a purchase, your available credit is reduced by the total purchase amount as a pending transaction on your credit card, just like normal. The difference is, the amount stays pending, and each time a payment is made the amount pending will decrease the payments amount until all payments are made.

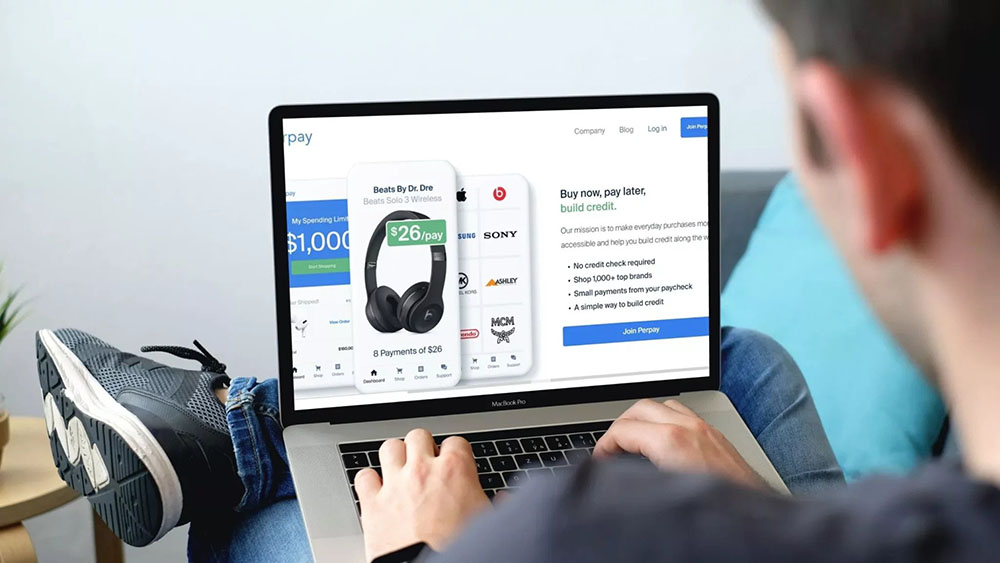

Perpay

If your credit is less than great, Perpay may be a good option for you. Perpay doesn’t check credit history, but instead uses your verified income to determine spending limits.

Pros & Cons

Pros

- Payments can be spread out over a 6 month period

- Spending limits are based on current income

- No credit check

- Helps rebuild credit

Cons

- Can only make purchases within Perpay’s marketplace

- Shipment is delayed until the first payment is made

- All scheduled payments must be made through payroll direct deposit

Perpay is located in Philadelphia, PA, and was founded in 2016. Perpay has over 3 million members, and in 2019 was named the fifth-fastest-growing private company by Inc. Magazine.

Perpay’s online market includes items from over 1,000 of the top brands. Perpay is also beneficial for improving credit scores. The average customer using perpay sees a credit score increase of 39 points. Making it an unbeatable option for customers who have a bad credit score and are looking to improve it.

Customers can access their spending limit and begin shopping within 60 seconds of completing their Perpay profile. Purchases are delayed in shipment until the first payment is made, typically on the consumer’s next payday.

While the typical formula for most buy now pay later apps is to have four equal payments of 25% of the total purchase price, Perpay splits purchases into equal installments over six months, according to your pay schedule. So if you are paid bi-weekly, or twice a month on average, you’d make 12 equal payments over six months.

Payments are made automatically through direct deposit from your payroll. No other forms are accepted unless you are making an extra payment.

Perpay will help rebuild consumer’s credit score by reporting their positive payment history to the credit bureaus after making four months of on-time payments when the combined total reaches at least $200.

Paypal

Paypal is a good option for those who are making a purchase between $30 and $600.

Pros & Cons

Pros

- Paypal is a trusted and familiar brand name

- No interest is charged

- Widely accepted form of payment

Cons

- Purchase limit of $600

- Each purchase requires approval

- Not available in all 50 states

PayPal is the biggest name in online payment processing for person-to-person payments. Their in-store and online purchases options have been ever expanding the last few years. Like other BNPL, payments are made over four equal payments. Pay in 4 is available at several big name retailers such as Best Buy, Bed Bath and Beyond, and Target for purchases ranging from $30 to $600.

Using Pay in 4 is simple, you just need a PayPal account that is in good standing, or you can open one at the time or purchase and link it to your bank account or credit card account. While at checkout, select to pay with PayPal, then select Pay in 4. You’ll receive an approval decision within seconds.

You will pay 25% of your total purchase amount at checkout, with the remaining 3 payments due every 15 days after. Currently Pay in 4 is not available to consumers in Wisconsin, Missouri, New Mexico, North Dakota, South Dakota, or any U.S. territories.

Klarna

Our final pick goes to Klarna. Klarna is a great option for those who are purchasing big ticket items. Klarna offers financing up to 36 months, and it’s virtual card numbers can be used both in-person and online.

Pros & Cons

Pros

- Can be used wherever credit cards are accepted

- Has a rewards program called Vibe

- No fees or interest when payments are made on time

- Card numbers are one-time use to enhance security

Cons

- Credit check is required for other financing options

- Purchases must be approved by Klarna

Klarna was founded in Sweden in 2005. Since its founding it has expanded within Europe and to the U.S. and now has over 90 million active customers with 250,000 merchants across 17 countries. Klarna is also now available to use on any purchase you wish to divide into smaller payments at every store that accepts credit cards. Using Klarna does not have an impact on your score when you choose their pay in 4 option.

When completing a purchase, you will create a virtual card in the Klarna app, then use that number to complete your purchase. As with other services you will pay your first payment of 25% of your total purchase price immediately, while the other 3 payments will be made every two weeks.

There is no interest charged as long as you make your scheduled payments on time. Consumers also have the option to pay the balance in full within 30 days with 0 interest, or use 6 – 36 month financing to help with larger purchases.

Overview

Buy now, pay later apps are a popular option for many consumers and online retailers today. With interest-free financing and simple repayment structures, these services have helped many consumers to be able to buy the things they need, while avoiding the financial trouble that can come from typical credit cards.

What is the Best Buy Now, Pay Later App For You?

There are several options when it comes to buy now, pay later apps. Most retailers partner with one BNPL for ecommerce transactions, so if you have a specific purchase from a specific retailer you want to make, start there first.

If you don’t have a particular retailer in mind, but are just looking to more options when it comes to shopping, consider these factors:

- How is your credit score? If you have a bad credit score, or little to no credit history, you’ll probably want to stick with a BNPL app that doesn’t check your credit score.

- Will your BNPL report to the credit bureaus? For those who are working on their credit score, BNPL apps that report to credit bureaus will be beneficial in raising their credit score with on-time payments.

- Where can you shop? When selecting a BNPL account, you’ll want to check to see where it is accepted. Choose one that is accepted at many of the places you shop.

- What will your credit limit be? BNPL apps vary in the amount of credit they provide. Other factors include the size of your purchase. Having a larger credit limit may make the difference in being able to complete your purchase.

- Consider fees and interest rates. No one likes fees or interest. Always check the account details to review any fees or interest. Will you be charged interest even if you make payments on time? If yes, what are the rates?

Using a Buy Now, Pay Later App Instead of a Credit Card

While there may be similarities to buy now, pay later apps, each plays their own roles in consumer credit. There are a few situations where you’ll want to use one payment over the other.

You’ll want to use a BNPL app if:

- You want to avoid a credit inquiry

- You want to pay over time without interest

- Paying off purchases with minimum payments is attractive to you

- You prefer a simple application with an instant decision

- You want to build your credit

You’ll want to use your credit card when:

- You’ll earn any rewards for your purchase such as miles, cash back, or points

- If there are any price, return, or purchase protection benefits

- If you’ll receive a complimentary extended warranty

- If you’ll get special discounts through store-branded retail card

- To have the flexibility of lower minimum payments

- If you need to meet a minimum spending requirement to receive a welcome bonus

Of course, not all credit cards will provide these benefits, many do not provide any. So it’s a good idea to review this before deciding how to make your purchase. You can check out your card’s guide or have a quick chat with customer service to figure this out. There’s also the option to replace your current card with one that does offer benefits.

FAQ

How Does a Buy Now, Pay Later App Work?

Buy now pay later apps work by partnering with the merchant you are looking to make a purchase from. Most BNPL apps will not charge interest as long as you are making the scheduled payments on time. If a payment is missed, you will likely be charged a late fee and interest. These fees and interest charges can vary, so it’s important to review them before continuing with your purchase. Many users who purchase through these apps wonder how the BNPL app makes money. By partnering with a merchant, BNPL apps earn a fee from the merchant to process the transaction, similar to how credit card transactions are made. It works out well for everyone, because the customer receives their product the want, the merchant makes a sale that they may not have otherwise made, and the BNPL app earns a fee for handling the transaction!

Can Buy Now, Pay Later Apps Help You to Build Your Credit?

Some BNPL apps do report to credit bureaus, meaning that by making your payments on time, you increase your credit score by showing credit worthiness. It’s worth noting that while there are some that do report to the credit bureaus, many do not, because the payment history is not long enough to warrant a report.

What Kind of Credit Do you Need to Use a Buy Now, Pay Later App?

The majority of BNPL apps do not perform a credit check. Those that do will perform a soft inquiry which will not affect your score at all. So if you have bad credit, there are still options out there for you to make a purchase through payments.

As an example, the BNPL app, Zebit has a two-step loan approval process.

First you will verify your identity, employment, and income in order to establish an initial spending limit. After that, each purchase you attempt to make will go through a quick approval process at checkout to determine if you can complete the transaction or not.

The bottom line is there are many types of BNPL apps with their own benefits, so in the end there is something for everyone! Take a look at your situation and shop around for the best one for you!